Discounted cash flow calculator online

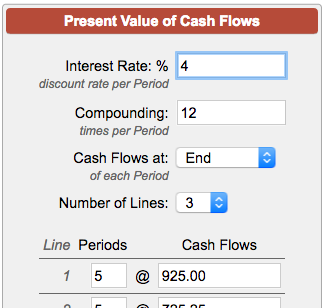

Enter the percentage of the business funded by equity finance. The discounted cash flow formula uses a cash flow forecast for future years discounted back.

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Online calculator for Discounted Cash Flow DCF stock analysis.

. DCF CF1 CF2. You will find many more tools to become a better investor such as the Discounted Cash Flow calculator. Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets.

This calculator finds the fair value of a stock investment the theoretically correct way as the present value of future earnings. Find the intrinsic value of a company with our simplified DCF calculator. Discounted Cash Flow Calculator.

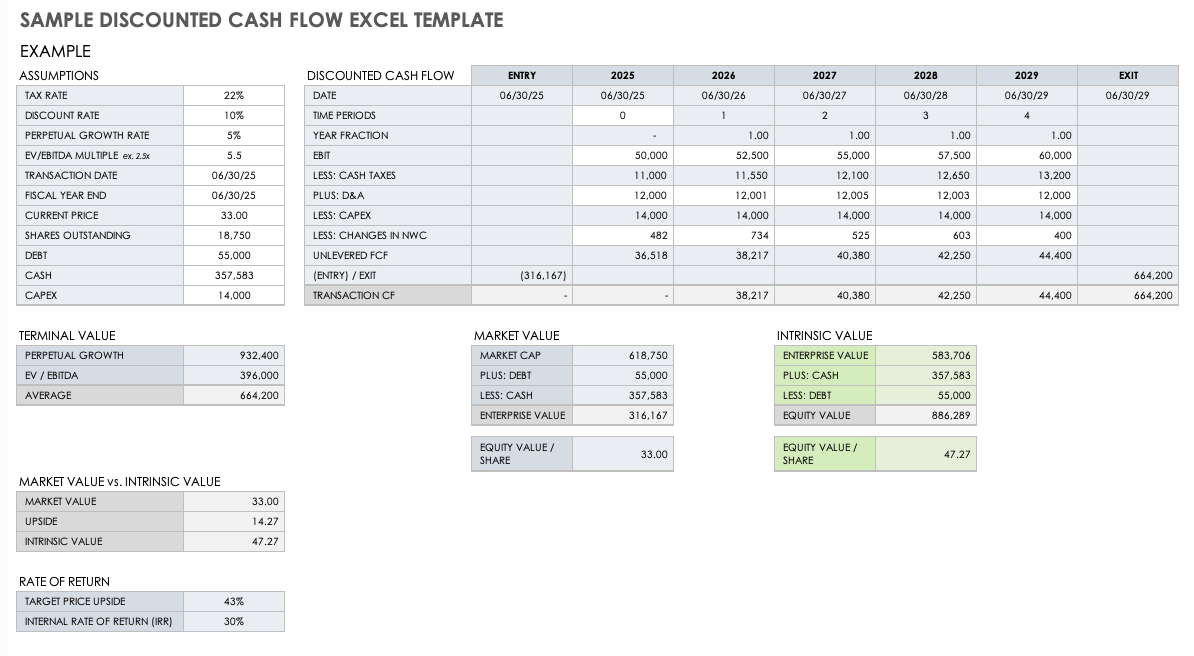

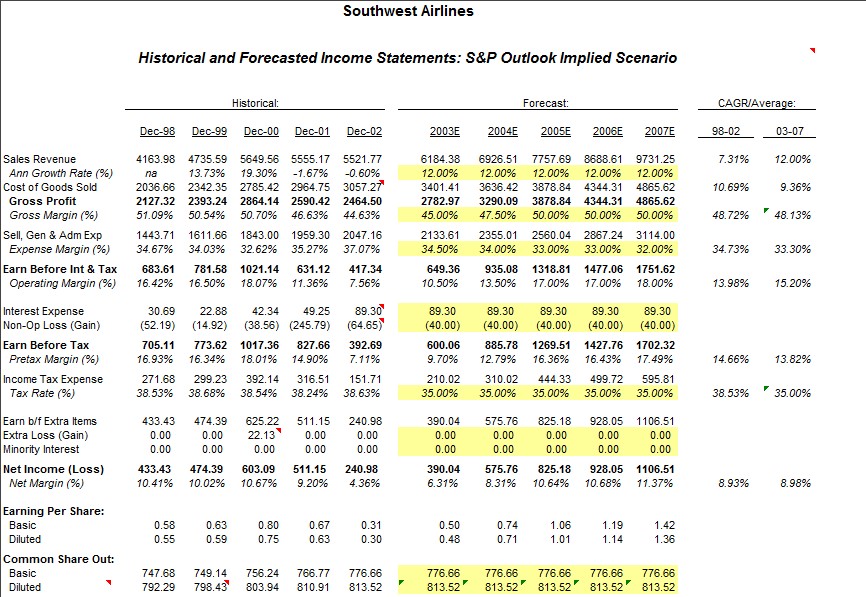

You can find company. Import your historical financial numbers and your projection for 3 to 5 years later. Enter the Equity Percentage.

The income approach the cost approach or the market comparable sales approach. DCF Tool is a calculator that performs valuation of stocks using the Discounted Cash Flow method. Discounted Cash Flow DCF Text.

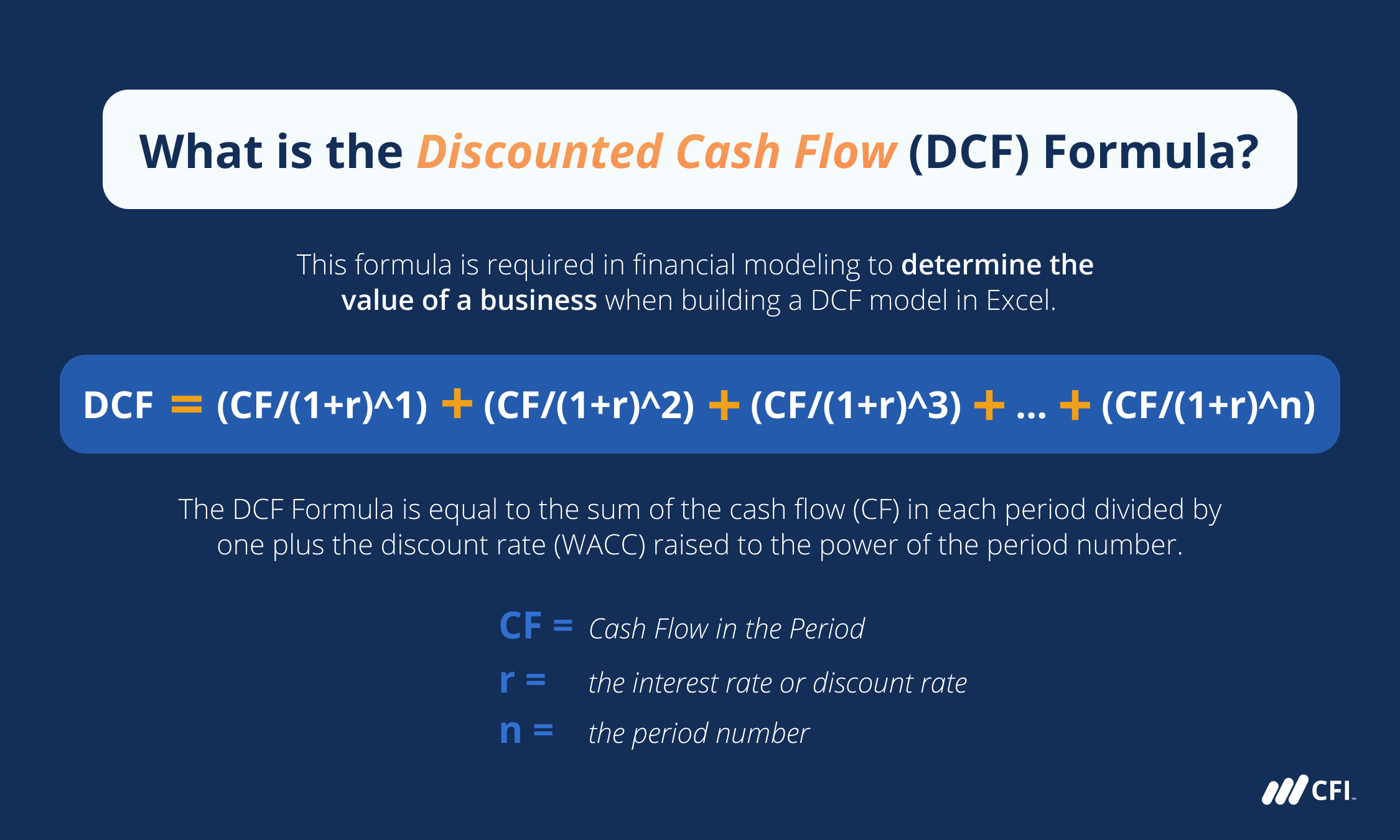

Discounted Cash Flow Analysis for. Discounted Cash Flow Calculator Online. The discounted cash flow is a quantification method used to evaluate the attractiveness of an investment opportunityDiscounted Cash Flow is a term used to describe what your future cash.

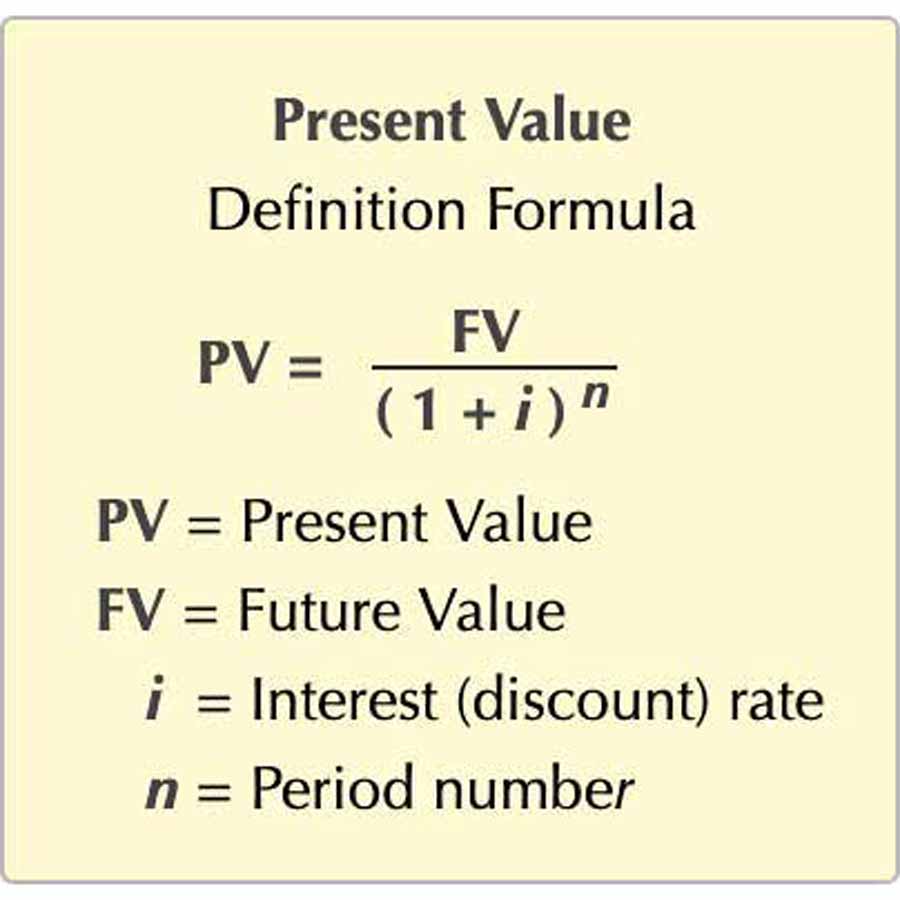

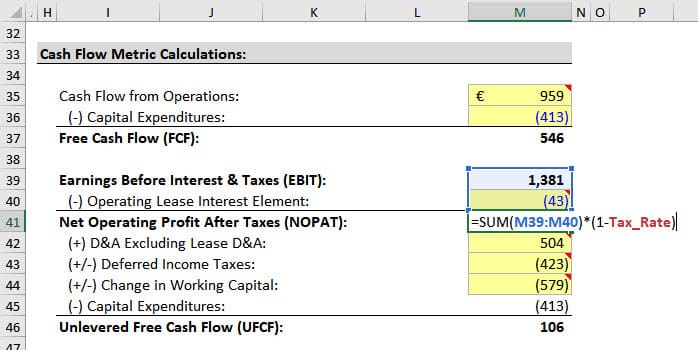

The DCF for each period is calculated as follows - we multiply the actual cash flows with the PV factor. Discounted Cash Flow analysis is widely used in finance. Discounted Cash Flow Calculator Online.

The DCF method can be used for the companies which have positive Free cash flows and these FCFF can be reasonably forecasted. Must be text. Instructions Please enter the following details regarding the stock whose intrinsic value you are.

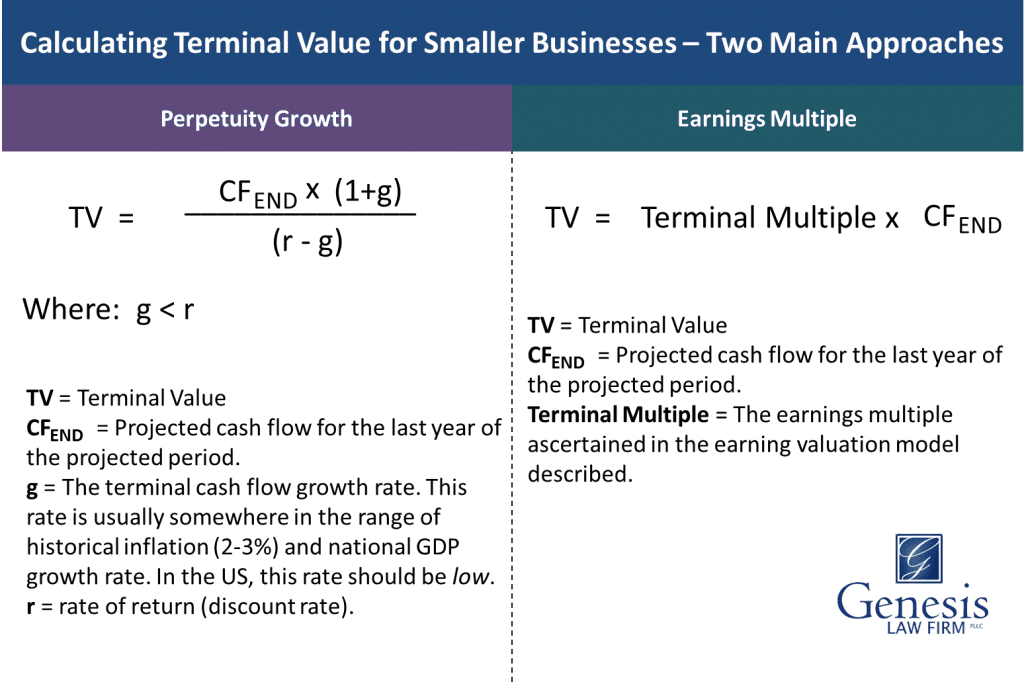

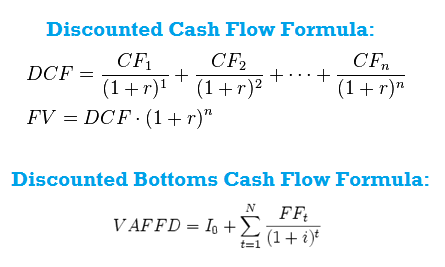

1r 1 1r 2 1r n. So it cannot be used for new and small companies or. Business valuation BV is typically based on one of three methods.

Discount Rate Perpetuity Growth Rate. For example if the total capital of a business is 75000 of which equity is 45000 and. Historical financial data and growth modeling are used to forecast future cash flows.

If the discount rate is 10 then we can calculate the DPP. Then regarding to your market. Find the market value of real estate in four easy steps.

Initial FCF Rs Cr Take 3 Years average. From that we can. Discounted Cash Flows Calculator.

Start tracking your investments today 14-day Premium trial 100 free after. Use our Discounted Cash Flow Calculator to perform DCF analysis for real estate investments. What do You Consider Short Term.

The discounted cash flow DCF formula is. Three steps in startup valuation with Discounted Cash Flows. A discounted cash flow analysis is a method of asset or company valuation.

Cash Flow Growth Rate.

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

How To Use Discounted Cash Flow Time Value Of Money Concepts

Discounted Cash Flow Analysis Study Com

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Dcf Model Full Guide Excel Templates And Video Tutorial

Present Value Of Cash Flows Calculator

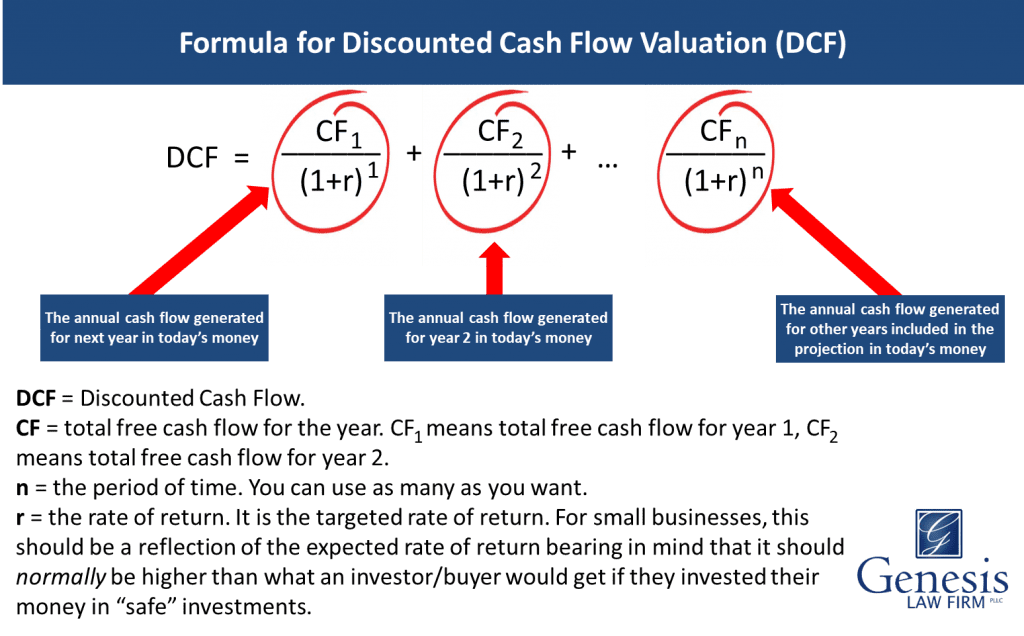

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

How To Calculate Discounted Cash Flow For Your Small Business

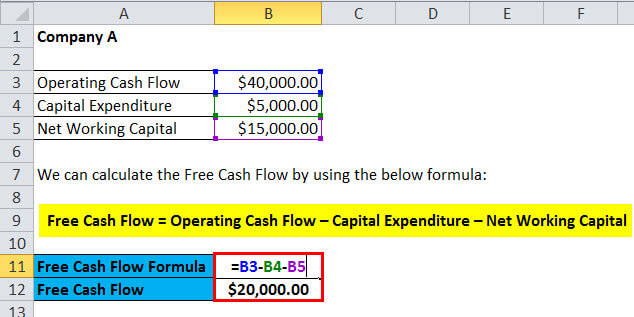

Free Cash Flow Formula Calculator Excel Template

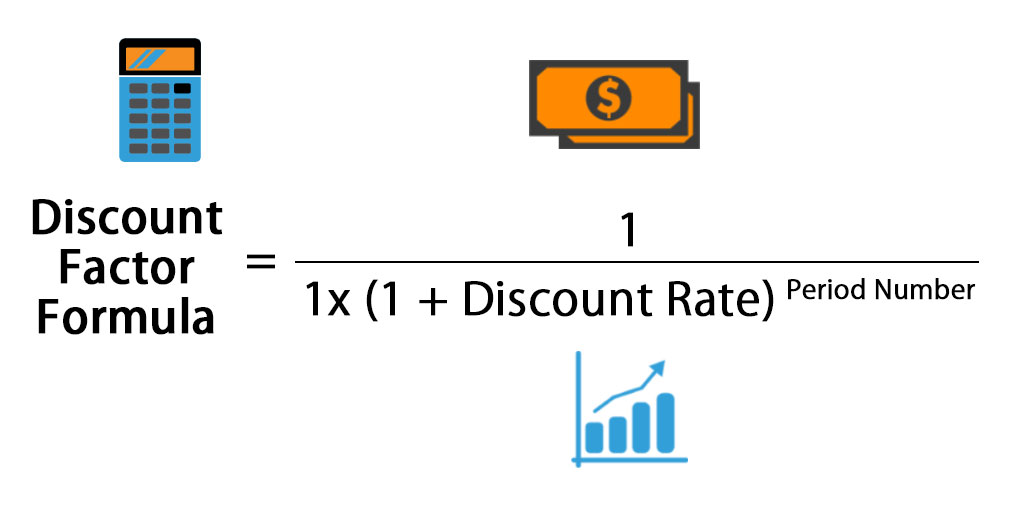

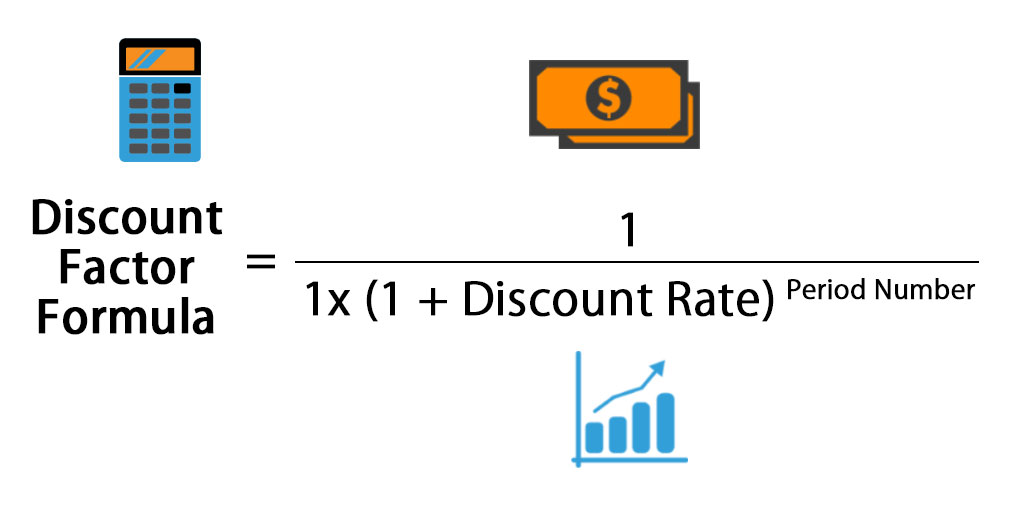

Discount Factor Formula Calculator Excel Template

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Excel Discount Rate Formula Calculation And Examples

Mid Year Convention Discounting Adjustment And Calculator Excel Template

Discounted Cash Flow Dcf Definition Analysis Examples

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich